TAX IMPACT & FINANCIAL INFORMATION:

The Bellville ISD tax rate is presently $1.15 per $100 of property value. The tax rate in Bellville has decreased 11 cents over the last three years due to House Bill 3. Learn more about House Bill 3 HERE:

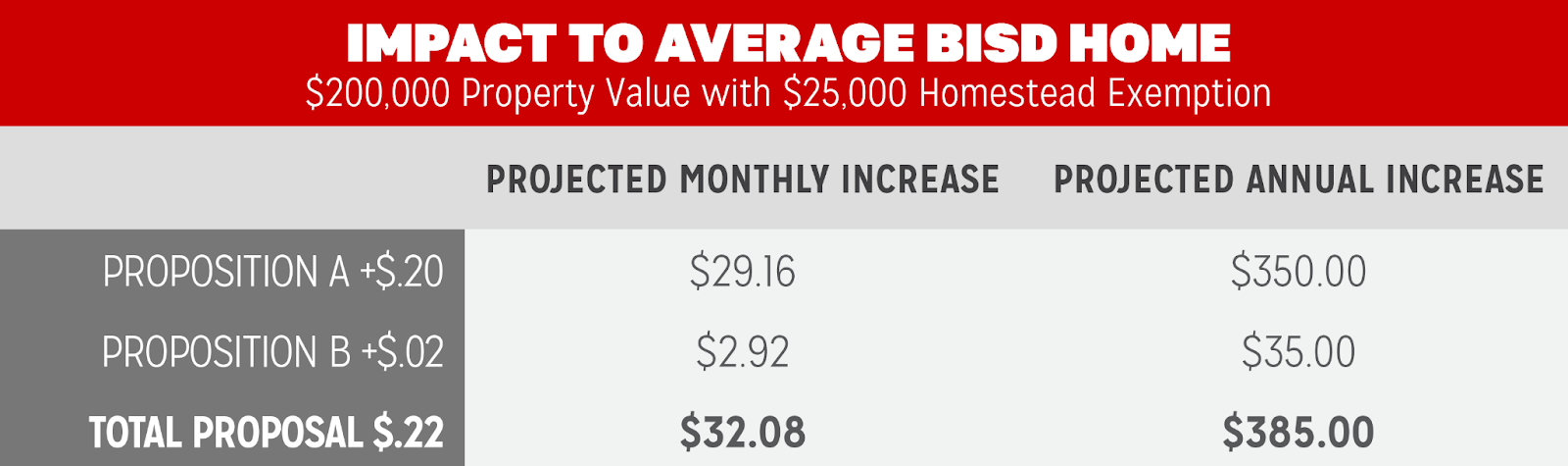

The estimated maximum tax impact of this bond election is 22 cents, 20 cents for Proposition A, and 2 cents for Proposition B. For the average home valued at approximately $200,000, the tax rate increase is approximately $32.00 per month.

Homestead Exemptions

For residents 65-years and older, their school district tax bill will not increase, even if their property values increase (excluding property improvements) as long as an approved Homestead and Over-65 Exemption application is on file with the Austin County Appraisal District, and the property has been owned as of Jan. 1 of the tax year.

For more information about Homestead and Over-65 Exemptions, call 979-865-9124 or go to https://www.austincad.org/wp-content/uploads/2018/09/96-1740-2.pdf.

Understanding the Tax Rate

Public school taxes involve two figures which divide the school district’s budget into two “buckets.” The first is the Maintenance & Operations (M&O) budget, also known as the General Fund. The M&O fund is used to pay for the day-to-day operations of a district and includes items such as salaries, utilities, food, gas, supplies, etc. Approximately 83% of Bellville ISD’s M&O budget is spent on personnel salaries, benefits and related costs.

The second is the Interest & Sinking (I&S) budget or Debt Service. This fund is used to repay debt for capital improvements approved by voters through bond elections. As a comparison, this fund is similar to a mortgage or home improvement loan. I&S funds may only be used to repay debt.

Proceeds from a bond issue can be used for the construction and renovation of facilities, the acquisition of land and the purchase of capital items, such as equipment, technology and transportation. By law, I&S funds cannot be used for the M&O budget, which means voter-approved bonds cannot be used to increase salaries or to pay rising costs of utilities or services.